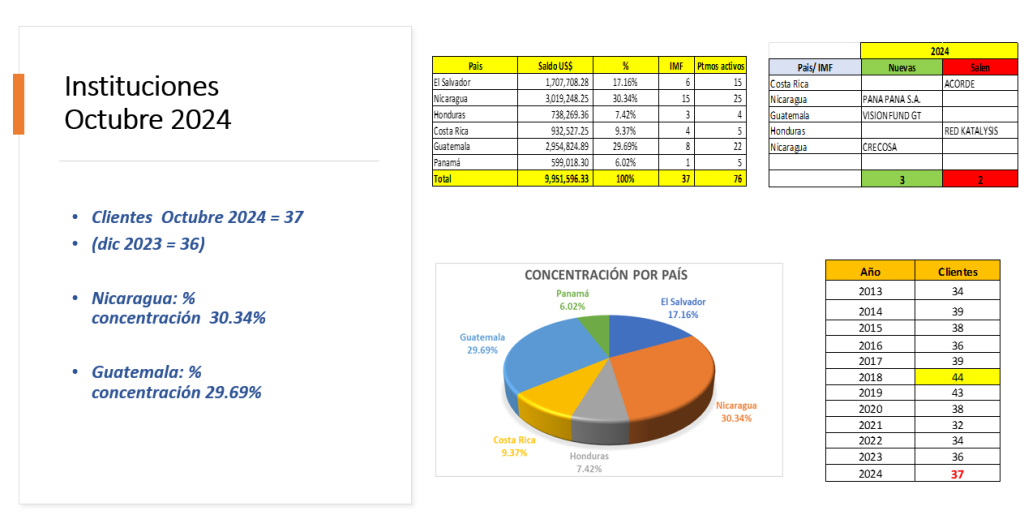

We are a financial company in the Central American and Caribbean region, recognized for the quality of its financial products and services, oriented to the needs of microfinance institutions, serving micro, small and medium-sized companies in the region.